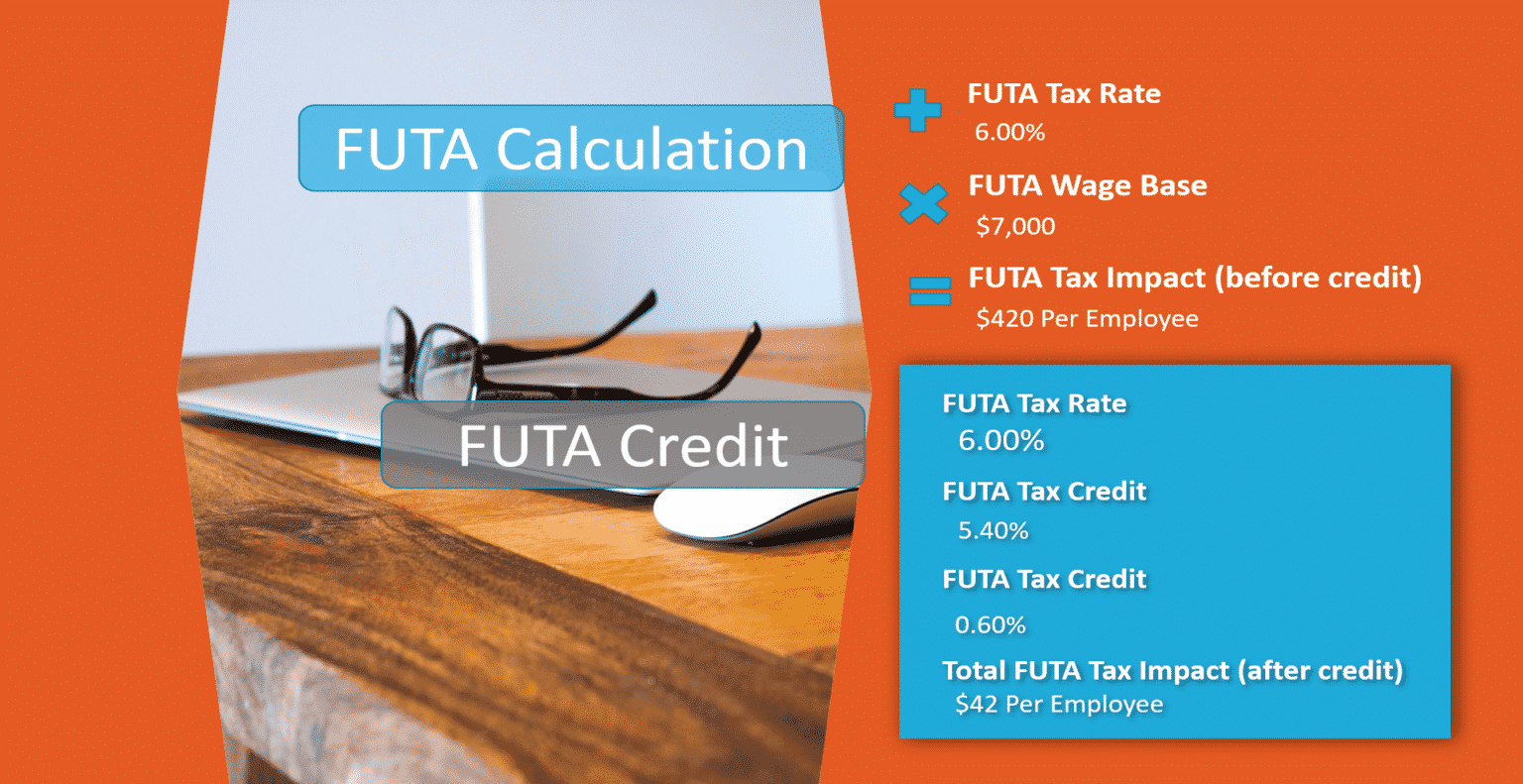

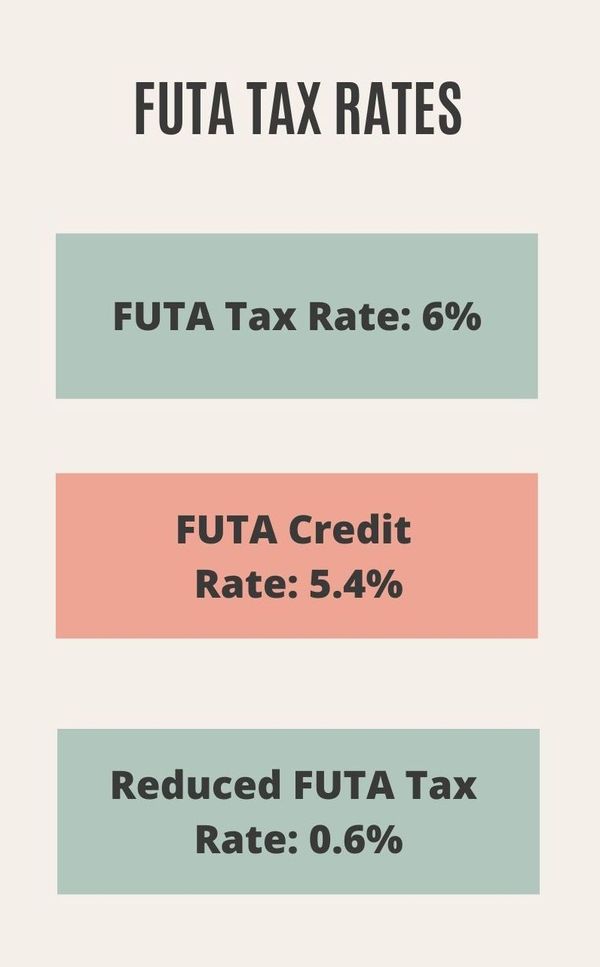

Futa Tax Rate 2024 Texas. Futa tax rates for 2022 & 2023 and taxable wage base limit. The futa tax rate for 2023 is 6%.

The futa tax rate for 2023 is 6%. Newly liable employers begin with a predetermined tax rate set by the texas ui law.

The Texas Unemployment Compensation Act (Tuca) And Other State And Federal Laws And Regulations Govern The Unemployment Tax Program.

Keep in mind the wage base is the limit of suta tax.

However, You May Receive A Credit For Timely Payment Of State Unemployment Tax Of 5.4%.

What is the futa tax rate for 2024?

The Chart Below Outlines 2024 Suta Employer Tax Rate Ranges.

Images References :

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

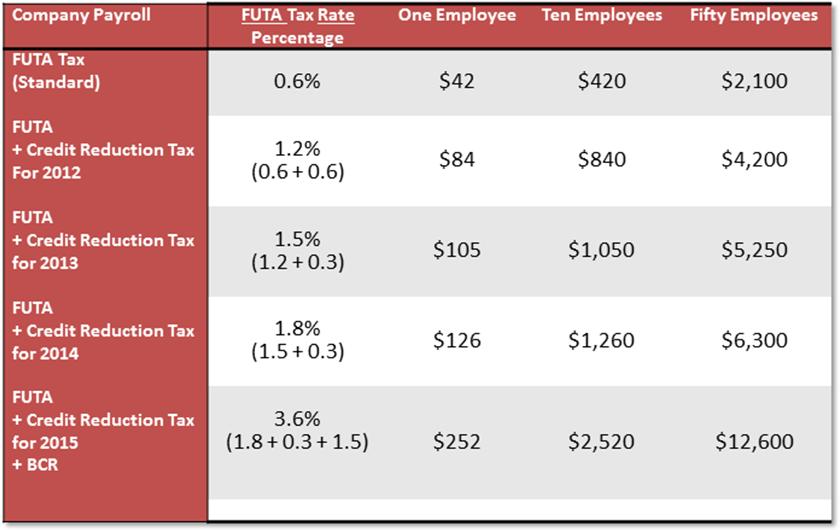

What is FUTA? Definition & How it Works QuickBooks, For budgeting purposes, you should assume a 0.90% futa rate on the first $7,000 in wages for all states with an additional percentage to be charged to cover the. Therefore, employers shouldn't pay more than $420.

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

What Is The Futa Tax Rate For 2022 EE2022, The futa tax rate for 2023 is 6%. Discover the texas tax tables for 2023, including tax rates and income thresholds.

Source: accuservepayroll.com

Source: accuservepayroll.com

What is FUTA? Federal Unemployment Tax Rates and Information for 2022, Employee 3 has $37,100 in eligible futa wages, but futa applies only. Federal payroll tax rates for 2024 are:

Source: www.deskera.com

Source: www.deskera.com

Complete Guide to FUTA tax, Employers who have not paid all contributions for the fiscal year ending june 30. The standard futa tax rate is 6% on the first $7,000 of each employee’s annual wages which means employers pay a maximum of $420 per.

Source: www.yourfundingtree.com

Source: www.yourfundingtree.com

FUTA Tax Rate Discover What It Is and How It Works, Discover the texas tax tables for 2023, including tax rates and income thresholds. Federal payroll tax rates for 2024 are:

Source: ifunny.co

Source: ifunny.co

FUTA Federal Unemployment Tax Act What is FUTA? The Federal, What is the futa tax rate? The futa tax rate is 6% on the first $7,000 in income.

Source: www.accuchex.com

Source: www.accuchex.com

FUTA Tax Calculation Accuchex, Suta tax rate and wage base 2024. The basic futa rate is 6%.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

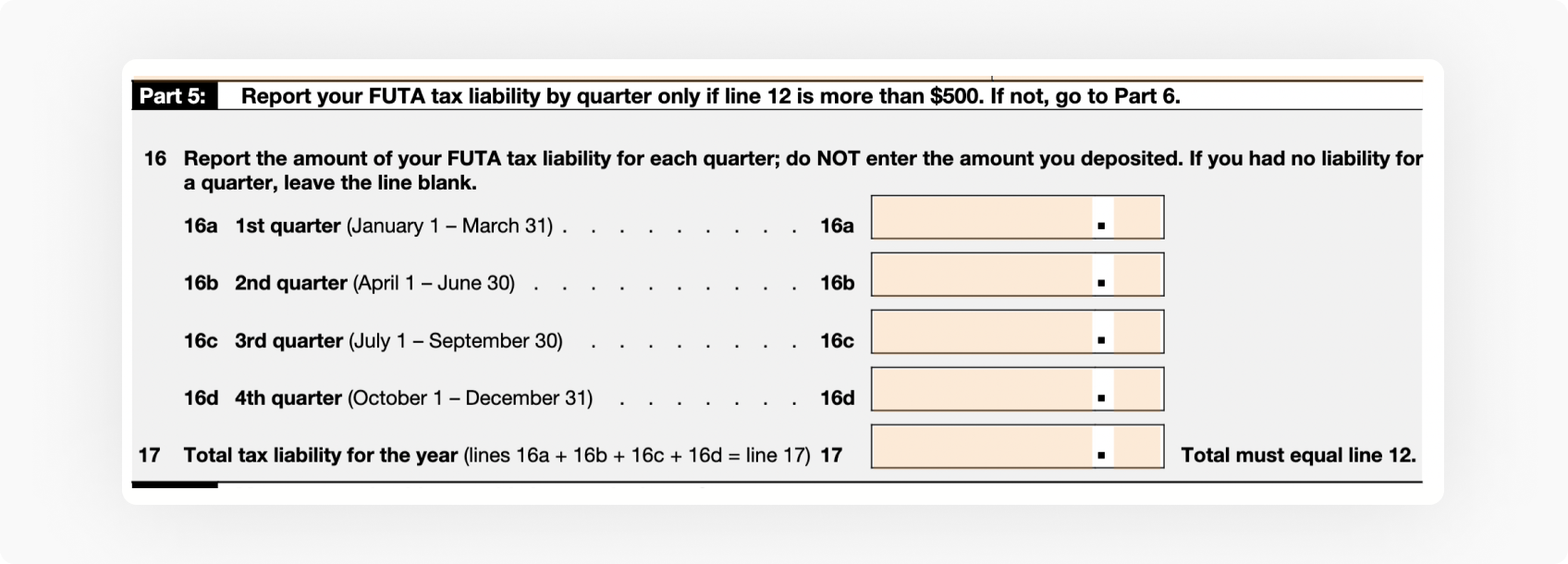

Federal Unemployment Tax Act (FUTA) Calculation & How to Report, Employers must pay futa taxes on employees who make $1,500 or more throughout the year. The futa rate is 6.0% (before state tax credits) of what you paid an employee during the quarter.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is FUTA Tax? Rate, Due Dates, & More, 6.2% for the employee plus 6.2% for the employer; If you pay your suta tax in full and on time, you may be eligible for a tax credit that lowers your futa tax rate from 6 percent to 0.6 percent.

Source: blog.pdffiller.com

Source: blog.pdffiller.com

form940instructionsfutataxrate202106 pdfFiller Blog, The 2024 futa tax rate is 6% of the first $7,000 from each employee's annual wages. An employer's sui rate is the sum of five components:.

Federal Payroll Tax Rates For 2024 Are:

Employers must pay futa taxes on employees who make $1,500 or more throughout the year.

This Brings The Net Federal Tax Rate Down To.

The standard futa tax rate is 6% on the first $7,000 of each employee’s annual wages which means employers pay a maximum of $420 per.